Part 3: The Nuts and Bolts of Various Financial Accounts

"Knowing is not enough; We must apply. Willing is not enough; We must do." – Bruce Lee

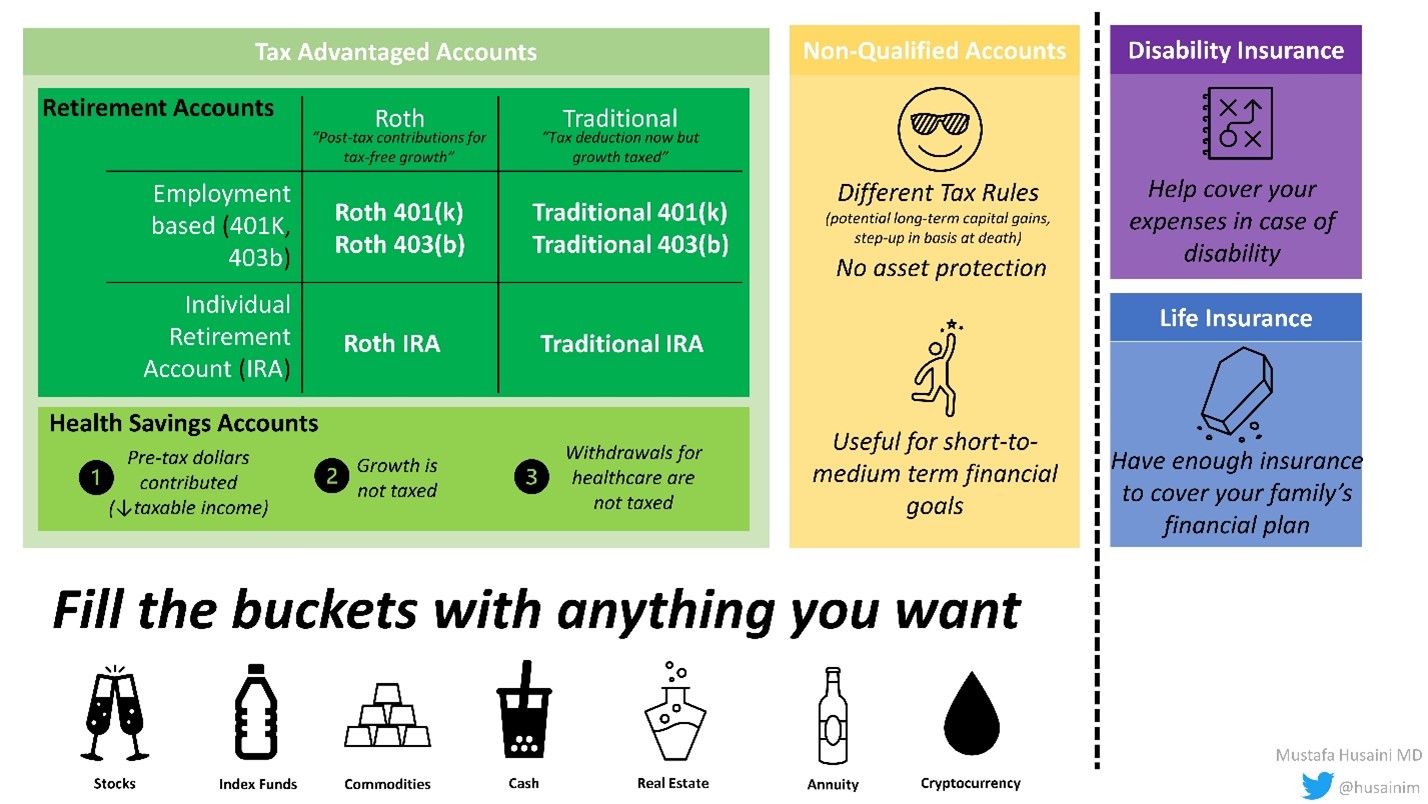

Now that you have explored your financial curiosity (part 1) and thought about your financial goals (part 2), we are now going to learn some mechanics of how we can achieve them. First, we will discuss the difference between what an account and investment is before discussing nuances of various accounts, focusing on distinctions within tax-advantaged accounts. We will review traditional accounts, Roth accounts, and health savings accounts (HSA).

Accounts vs. Investments

At some point, most of us have heard various financial terms such as 401K, HSA, stocks, bonds, Roth, Bitcoin, etc. The first important distinction is knowing the difference between accounts and investments. Quite simply, accounts are the "bucket" that our investments then go into (Figure 1). The next important distinction is between non-qualified buckets and tax-advantaged buckets. Non-qualified buckets are regular accounts that can be held at various companies (Vanguard, Fidelity, etc.) and do not have asset protection or tax benefits. When sold, growth is taxed as either ordinary income (within the first year) or long-term capital gains (after the first year). Tax-advantaged accounts, such as for retirement and HSAs, can offer asset protection and tax benefits but come with strings attached. For example, retirement accounts cannot be used until after age 59.5 and HSAs can only be utilized for unreimbursed medical expenses.

As previously discussed in part 2, once you have an idea of your short and long-term goals, and assuming you have a long-investing horizon, you should consider getting maximum use from the tax-advantaged vehicles first before using non-qualified accounts. Each account should have a specific asset allocation in mind with each individual investment's risks, expenses, taxes, and potential gains considered. As you progress on your financial journey, it will be imperative to learn about tax efficiency. While taxes should not be the main driver when selecting the investments that are right for you, they are important to understand before you make your decisions. Some investments are taxed very favorably, and others are less tax-efficient. You should consult your CPA or financial advisor for guidance, as this is a complicated and ever-changing landscape, but one that can have a much larger impact on your bottom line than even fees and expense ratios. A mutual fund may have an expense ratio of 1% but owning tax-inefficient investments may cost you 30% or more between taxes and penalties.

Lastly, other accounts that are important to consider within your financial plan include life insurance and disability insurance. As these have been covered in prior Fellows in Training (FIT) articles, we will just highlight some basics. For life insurance, most FITs/Early Career Professionals likely need term life insurance, typically avoid whole life insurance, and may consider other types of permanent coverage depending on their situation [Variable Universal Life Insurance, Indexed Universal Life, etc.] There are many differing opinions on this, and it is important to purchase the type and amount of coverage that is right for you, and not to get sold a policy that does not fit your needs.

Disability insurance should be obtained early if possible because it gets more expensive as you get older and if you develop any medical conditions; also, future coverage from your employer may offset what you can buy on the private market. Personal long-term disability coverage allows a stricter definition of disability and is paid with after-tax dollars so claims can be tax-free. Employer-based group plans are often easier to qualify for and are cheaper, and if they are paid for by your employer, you will owe taxes on any payouts. You should check if your employer's long-term disability plan is specialty-specific as most of them are not.

Retirement Accounts

One of the easiest ways to understand the basic permeation of various accounts is with our classic 2x2 table (Figure 1). Across one axis are employment-based retirement accounts [401(k), 403(b), etc.] and individual retirement accounts. You can participate in either or both types of accounts. In the tax year 2021, the IRA contribution limit is $6,000 and the employee retirement account limit is $19,500. Across the other axis is Roth versus Traditional.

Traditional accounts allow pre-tax contributions which lower your current taxable income. In exchange, you must pay income taxes on the growth when you withdraw the funds in retirement (at whatever your future tax rate may be at that time). Roth retirement accounts, named after Senator William Roth, were instituted in 1997 and let you contribute money on which you have already paid tax. In exchange, there are no taxes owed on the growth of qualified withdrawals.

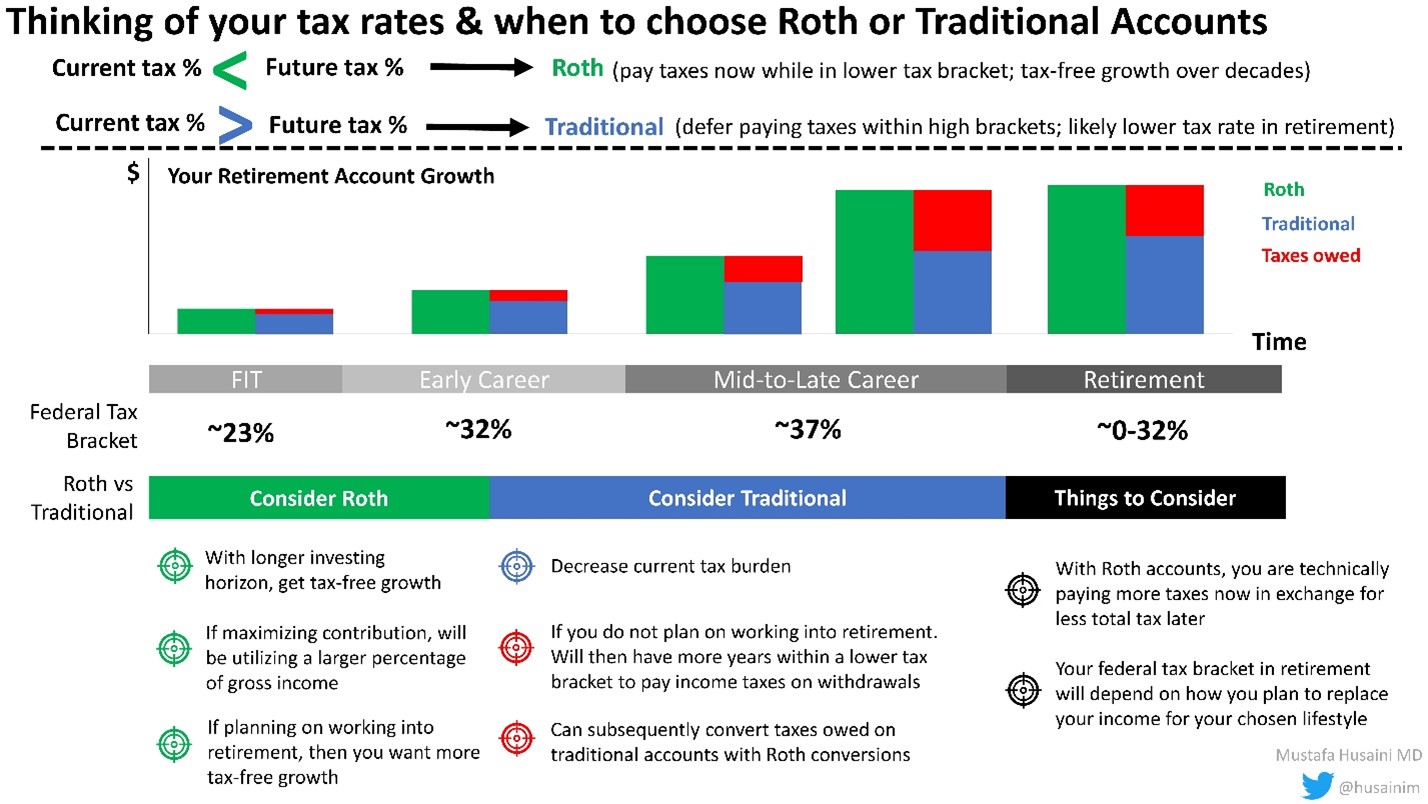

Figure 2: Potential Tax Implications of Roth and Traditional Retirement Accounts

Figure 2: Potential Tax Implications of Roth and Traditional Retirement Accounts Click the image above for a larger view.

As most of us have the benefit of compound interest working in our favor over our long-term investment horizon, there are some features that we need to understand to maximize the benefit of these accounts (Figure 2). First, there is an income limit for Roth IRA. For 2021, direct Roth IRA contributions can only be made if your salary is below $140,000 (single filling) or $208,000 (married filling). If you are above these income limits, however, you can still contribute to a Roth 401(k) if offered by your employer, or through a backdoor Roth IRA (BDR 1, BDR 2, BDR 3). Another important distinction is understanding your tax implications. When you are in lower tax brackets, utilizing Roth accounts can allow for decades of tax-free growth. When you are in your peak earning years, utilizing traditional accounts can lower your taxable income and could allow you to pay a lower tax rate on the growth in retirement. With appropriate financial planning and the use of appropriate-timed conversions, one can minimize their tax burden.

HSA accounts

HSA accounts can be utilized when you have a high deductible health plan (HDHP). In contrast to a flexible spending account (FSA), HSA funds carry over year to year. The major benefit of an HSA is that they offer the trinity of tax savings; contributions lower your gross income, growth is tax-free, and withdrawals at not taxed when used for health care expenses. An HSA can be independently funded outside your employer, but certain payroll taxes (Medicare, social security) are not deducted. Finally, it is important to only utilize an HSA if an HDHP is right for your health insurance needs.

Next to Come

As we head into the final turn of our journey together, we will finish our introduction to financial planning with an example of a financial plan. Now that you know and have the will, we must do!

Homework

- Use your homework from sessions #1-2 to incorporate your financial goals with these various financial accounts. When thinking about which accounts to use, be sure to estimate your current tax rates relative to future tax rates.

- If you have an employer match, confirm that they will still match your contributions if you switch to Roth 401(k) or 403(b).

This article was authored by Mustafa Husaini MD, FACC,with input by Rahul Chhana, MD (FIT at Washington University in St. Louis) and my personal financial adviser Mohammed Esmail, CFP

This content was developed independently from the content developed for ACC.org. This content was not reviewed by the American College of Cardiology (ACC) for medical accuracy and the content is provided on an "as is" basis. Inclusion on ACC.org does not constitute a guarantee or endorsement by the ACC and ACC makes no warranty that the content is accurate, complete or error-free. The content is not a substitute for personalized medical advice and is not intended to be used as the sole basis for making individualized medical or health-related decisions. Statements or opinions expressed in this content reflect the views of the authors and do not reflect the official policy of ACC.