Part 2: How to Approach Your Financial Plan: The Ant & The Grasshopper

"A Grasshopper frolicked while an Ant stored food for the winter. When winter came the Ant was comfortable; the Grasshopper not so."

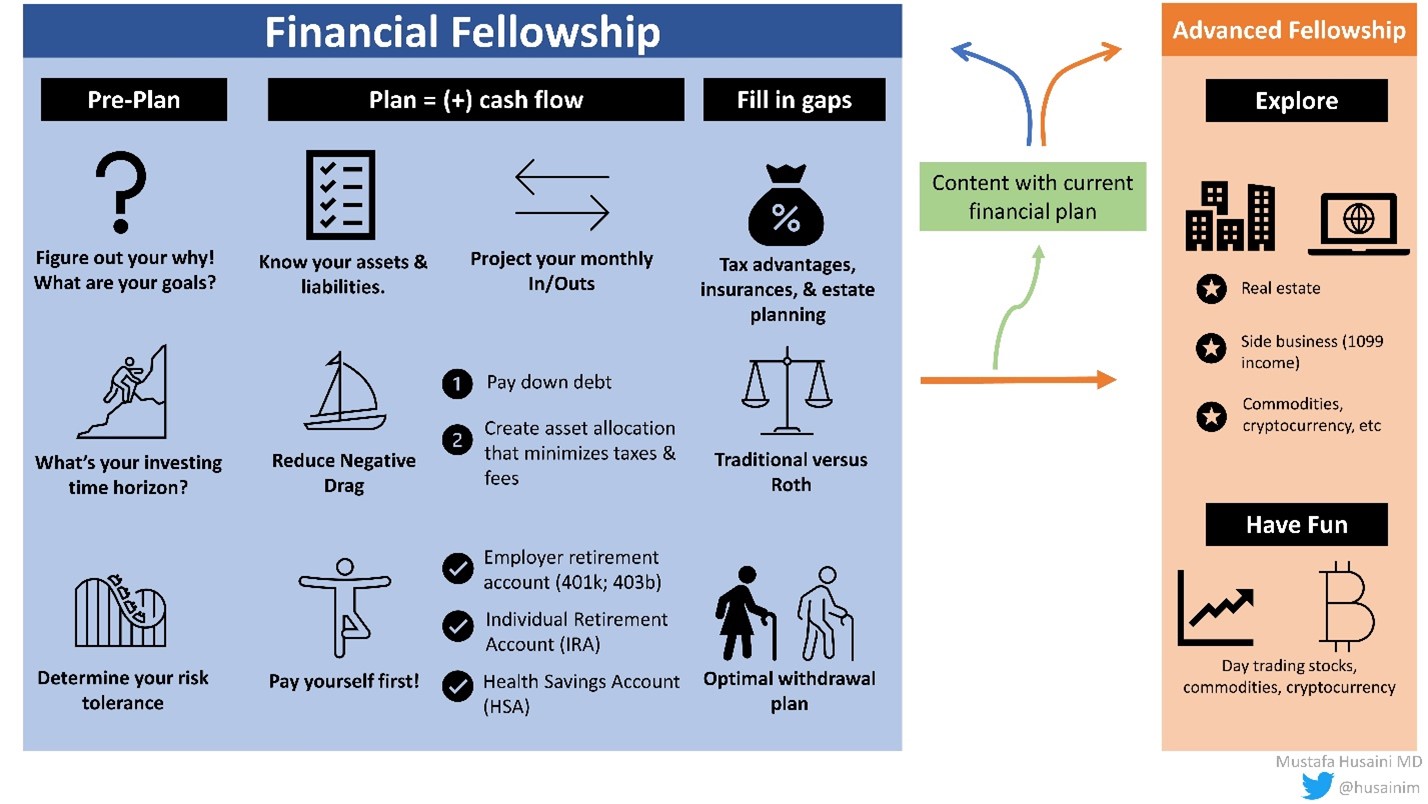

The Ant and The Grasshopper is a fable by Aesop which teaches children about the importance of hard work and delayed gratification. During the summer, the Ant prepares for winter while the grasshopper enjoys the sun. When winter came, the grasshopper had nothing to eat while the ant had a wonderful winter. We all have, within us, components of both the ant and the grasshopper. Do we save for retirement or do we spend money on something that we want right now? As we enter the next stage of our lives where we are attempting to grow our career, enjoy life, and reduce the risk of burnout, your personal finances should be a source of comfort rather than a source of added stress. Here, the first step is creating a framework that all of us can use as we approach our own financial security and independence (Figure 1).

Importance of a Financial Plan

It is well known that financial education is a major deficit in our training. Many of us postpone or even ignore financial education; nonetheless, there are benefits of starting early. For example, there are investment vehicles available to FITs (due to lower tax brackets) that may not be available during attending years. Additionally, investment earnings are compounded, making every dollar invested (or saved) today worth exponentially more in the future. Whether going alone or with a professional to manage your finances, it is imperative that you create and understand a personal financial plan that reflects your life goals, allows you to maximize your wealth and minimizes your tax burden.

Time Horizon

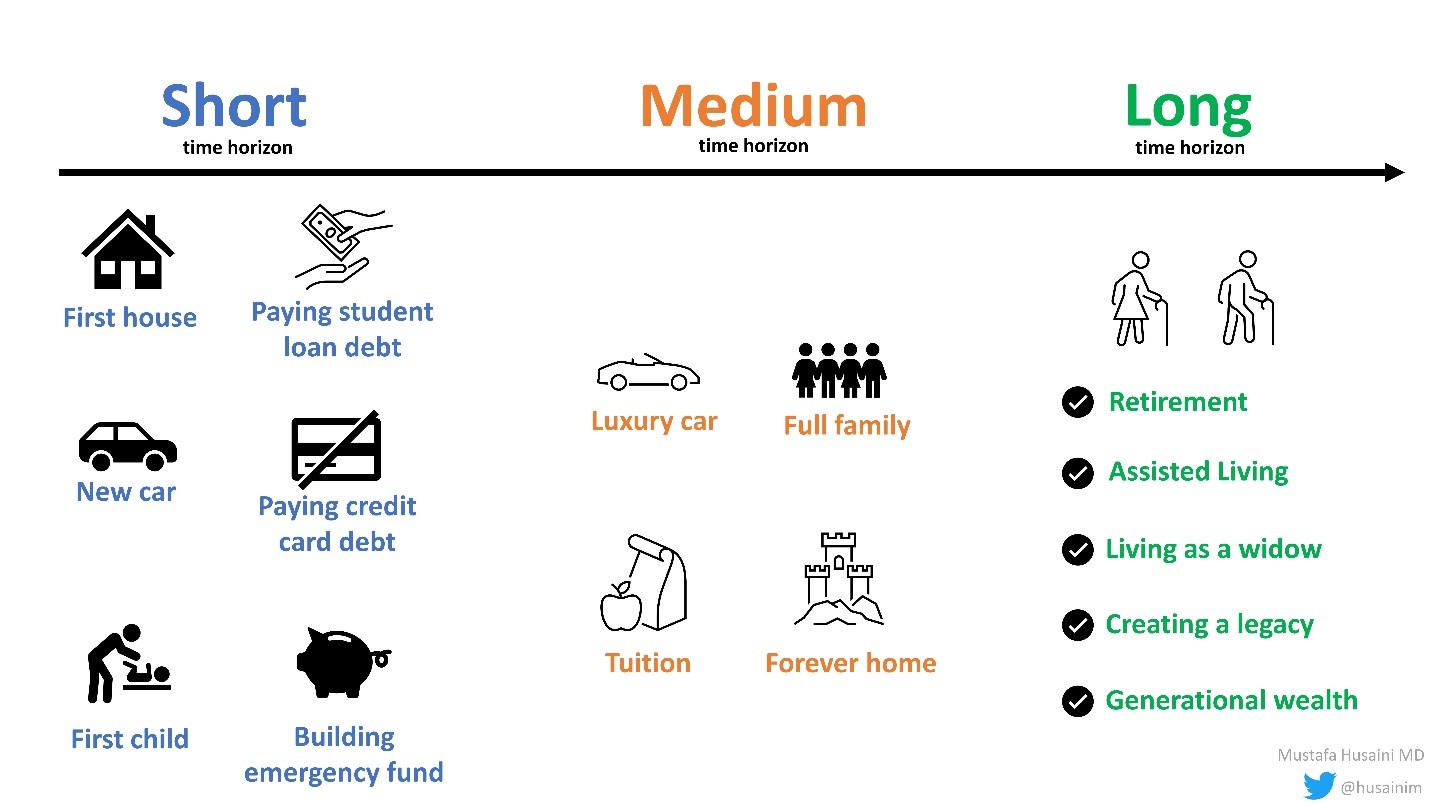

In order to achieve the financial goals that you created in part 1 (Figure 2), we need to discuss the time horizon of investing (THI) next. The THI is essentially how long you can let the money stay invested before needing it. In order to best determine this, you need to understand your cash flow. If you have upcoming expenses, such as moving expenses or a house down payment, then your THI will be short. With a shorter time-horizon, you'll need to reevaluate your risk tolerance and determine if you would rather have your money in cash (no risk, but also no growth) or a taxable investment account (higher risk of short-term loss, but higher potential return). If investing for the short-term, one could see a potential double-digit return with short-term trading (result of shallow risk). With that risk, however, comes the possibility of losses. Furthermore, investments held for less than one year are subject to short-term capital gains taxes which are treated as ordinary income (taxed at your highest marginal bracket).

If your emergency fund is set and there are no anticipated major expenses, then the THI will be longer. Over longer periods of time, you can recover from short market crashes and increase the value of your investments. For example, if you had invested in the stock market in 2007 and had a short THI (such as 2009), you would have lost a lot of money in the 2008 financial crash. However, if you invested in the stock market in 2007 and had a long THI (such as 2021), you would have made significant gains despite the 2008 and COVID-19 market crashes. If you were able to stay invested, those crashes were just temporary paper losses. Depending on the account type, this longer-term growth will be taxed as income (tax deferred retirement accounts), capital gains tax (0-20%), or not at all (Roth retirement accounts).

Reduce Negative Drag

The second major component of your financial framework is to minimize the amount of negative drag on your net worth. Negative drag can take the form of debt – often coupled with high interest rates – and taxes/fees. By aiming to have a high income-to-debt ratio, planning the appropriate asset allocation, and having a long-term investing horizon, one can optimize the former and minimize the later. In order to start accumulating wealth, it is paramount to reduce the amount of negative drag – especially financial debt – on your net worth.

Not all debt is considered bad debt as there is a time and place where the short-term cash flow is needed. For example, during training, when one has a limited income, debt can help pay for school and other life expenses. It is imperative, however, to not become comfortable with debt once you can pay it off and start accumulating wealth. For the average FIT, the biggest contributor to bad debt is credit card debt. These entail hefty interest rates, sometimes more than 20%. These should be tackled as quickly as possible. Another consideration for student loan debt is potential loan forgiveness, which is a topic which has been written about extensively (PSLF,WCI, TPP).

More important for this discussion today, however, is the need to ensure the bad debt is not causing a drag on your net worth. In business, when an institution is deciding whether to make a big purchase, they create a pro forma which projects the expected income and expected expenses. If they cannot project profitability within three years, then they skip the purchase. Similarly, we should use this mindset and not pursue large expenses unless we have a plan to ensure we are in the black at the end of our investing time horizon.

Pay Yourself First

As Aesop's ant was able to prepare for winter, we – as FIT/EC – need to prepare by paying ourselves first by investing in yourself and saving for retirement. By earmarking income prior to your expenses and starting early in your career (the wizardry of compound interest!), you will ensure that your long-term goal of financial independence is met. Due to the longer training required, we are often behind almost up to a 10-year delay to starting our investment plans, not to mention having to dig out of a higher amount of student loan debt as well. So, there is no time like the present to get started!

In our next article, we will delve into the nitty-gritty of various accounts – such as tax-advantaged retirement accounts, health savings accounts, etc. – and illustrate how to start creating your financial plan. Once we are financially secure, we can join Aesop's grasshopper and enjoy the sun while being prepared for the upcoming winter.

Homework

- List out short-term, medium-term and long-term goals

- List your good debt and bad debt with their interest rates

This article was written with input by Rahul Chhana, MD, FIT at Washington University in St. Louis, and my personal financial adviser Mohammed Esmail, CFP, (esmailfinancial.net).

ACC Members, discuss

this on Member Hub.

This content was developed independently from the content developed for ACC.org. This content was not reviewed by the American College of Cardiology (ACC) for medical accuracy and the content is provided on an "as is" basis. Inclusion on ACC.org does not constitute a guarantee or endorsement by the ACC and ACC makes no warranty that the content is accurate, complete or error-free. The content is not a substitute for personalized medical advice and is not intended to be used as the sole basis for making individualized medical or health-related decisions. Statements or opinions expressed in this content reflect the views of the authors and do not reflect the official policy of ACC.