The One Book That Changed How I Think About Money

As a physician, I often feel that talking about money is taboo. Unfortunately, I'm more practical than I am an idealist, and I believe that medicine, like anything else, is a business at the very core. A hospital that cannot fund its costs will not be able to care for patients for long. At some point, vaccines, medicines, imaging and testing need funding.

I found and read Rich Dad, Poor Dad by Robert Kiyosaki when I was an intern. Loaded with debt, I knew I needed to be judicious with my limited salary and time.

In the book, Kiyosaki describes how his dad had a PhD and an uninformed opinion of money. His friend's dad on the other hand, who is the main educator in the book, built a large, profitable business in Hawaii with only a high school education.

Now as a fellow that has been in the medical field for the past 10 years, I relate too much to Kiyosaki's dad: highly educated with very little financial education. In medical school we got a one-hour lecture on finance; it was a snooze fest, and none of my classmates cared because it wasn't going to be on Step 1.

The same goes for my public school education. While I spent two whole years learning calculus and precalculus, I only dedicated time to one project in the seventh grade learning how to balance a checkbook or make well-informed financial decisions.

Similar to the author and like a good immigrant, I believe that education is the key to success. The first chapter opens with an audacious quote, "Most people never study the subject [of money]. They go to work, get their paycheck, balance their checkbooks, and that's it. On top of that, they wonder why they have money problems. Few realize that it's their lack of financial education that is the problem."

...that's a pill harder to swallow than PO potassium.

Kiyosaki passes on one rule from his rich dad: "You must know the difference between an asset and a liability, and buy assets."

The definitions he uses are very simple:

- Assets are anything that puts money in your pocket.

- Liabilities are anything that takes money from your pocket.

With these simple definitions, I've begun to reclassify what I purchase. Below are some examples.

|

Assets |

Liabilities |

|

|

As doctors, we're all used to delayed gratification, and I'm not advocating for more. Instead, I'd recommend being brutally honest with your potential purchases and put each into one of these two categories. Instead of limiting your purchase of liabilities (although if you're overspending, you probably should), buy more assets.

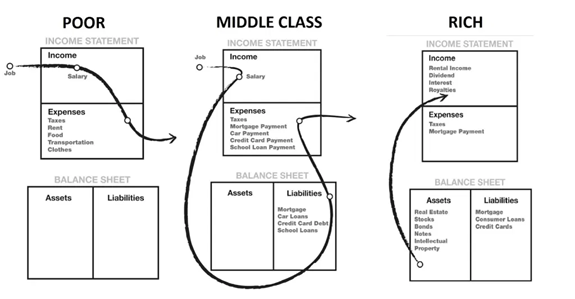

In the figure below, I find the labels a little harsh. If being harsh helps you put things in perspective, then go for it; I'd rather ignore them. Figure 1 shows a cash flow diagram to illustrate different ways money flows through people's lives. It's oversimplified but it gets the point across.

The line in each diagram represents where cash flows.

- In the far left, income comes from the job, flows through a litany of expenses, and down the tube.

- In the middle diagram, money comes in from the job, diverts to liabilities (which take a chunk of cash every month), through the expenses box, then flows down the tube.

- In the far right diagram, income is used to purchase assets. These assets in turn produce their own income, which can be used to buy more assets. This creates a positive feedback cycle by looping more and more money into income box.

That positive feedback loop is the goal. By creating this positive feedback loop, what you purchase ends up putting more and more money into your income column. Make money work for you buy closing the positive feedback loop. Bonus points if you use your assets to buy whatever liabilities your heart desires.

Key concepts:

- You must know the difference between an asset and a liability, and buy assets

- People with assets make money work for them, while most everyone else works for money

- Close the feedback loop!

Further Reading:

Deep Dives:

- The White Coat Investor by Dr. James Dahle

- The Total Money Makeover by Dave Ramsey

- MONEY Master the Game by Tony Robbins

- I Will Teach You to Be Rich by Ramit Sethi

Figure 1: Three different cashflow diagrams with arrows that show the flow of money. In the left diagram, income is used to buy and pay for expenses. In the middle diagram, income is used to buy liabilities which pass on monthly fees into the expenses column (e.g. Netflix, Disney+, the other-other streaming service, the peloton app). In the far right cashflow diagram, income is used to buy assets. Assets then flow money back into the income statement, creating a positive feedback loop. An arrow has been added to the far right diagram to show money flowing from Income to Expenses to Assets, illustrating the closed cycle of money. Source: Rich Dad, Poor Dad.

This content was developed independently from the content developed for ACC.org. This content was not reviewed by the American College of Cardiology (ACC) for medical accuracy and the content is provided on an "as is" basis. Inclusion on ACC.org does not constitute a guarantee or endorsement by the ACC and ACC makes no warranty that the content is accurate, complete or error-free. The content is not a substitute for personalized medical advice and is not intended to be used as the sole basis for making individualized medical or health-related decisions. Statements or opinions expressed in this content reflect the views of the authors and do not reflect the official policy of ACC.

ACC Members, discuss

this on Member Hub.