A Case For the 401(k)-Retirement Fund: Part 3

In this three-part series, I will be discussing the 401(k)-retirement fund from my perspective. In part three, I will discuss a step-by-step guide to my process and how I got my co-fellows into better plans.

In Part 1, we talked about how tax-advantaged retirement accounts like the 401(k) creates advantages for you with the employer match and compound interest. Using plans like these help you save for retirement without thinking about it. This is a huge advantage since most of us are terrible at saving for a rainy day.

In Part 2, I spilled the beans on how to evaluate these funds to find the most advantageous fund while optimizing for the lowest costs. This plan set my co-fellows up to make I set up my co-fellows to make $1,481,711.08 more than the default option*.

The key is to look for:

- Low turnover rate

- Focus on longest projected performance (usually 10 years)

- Mind the fees (Expense ratio)

I did some rough calculations on an excel spreadsheet that you can use for your own projections.

Now that you know how to compare plans and have a tool to understand how your money will compound over time, let's get into the nitty-gritty; the step-by-step guide to picking your 401(k). The guide no one gives you.

The deets:

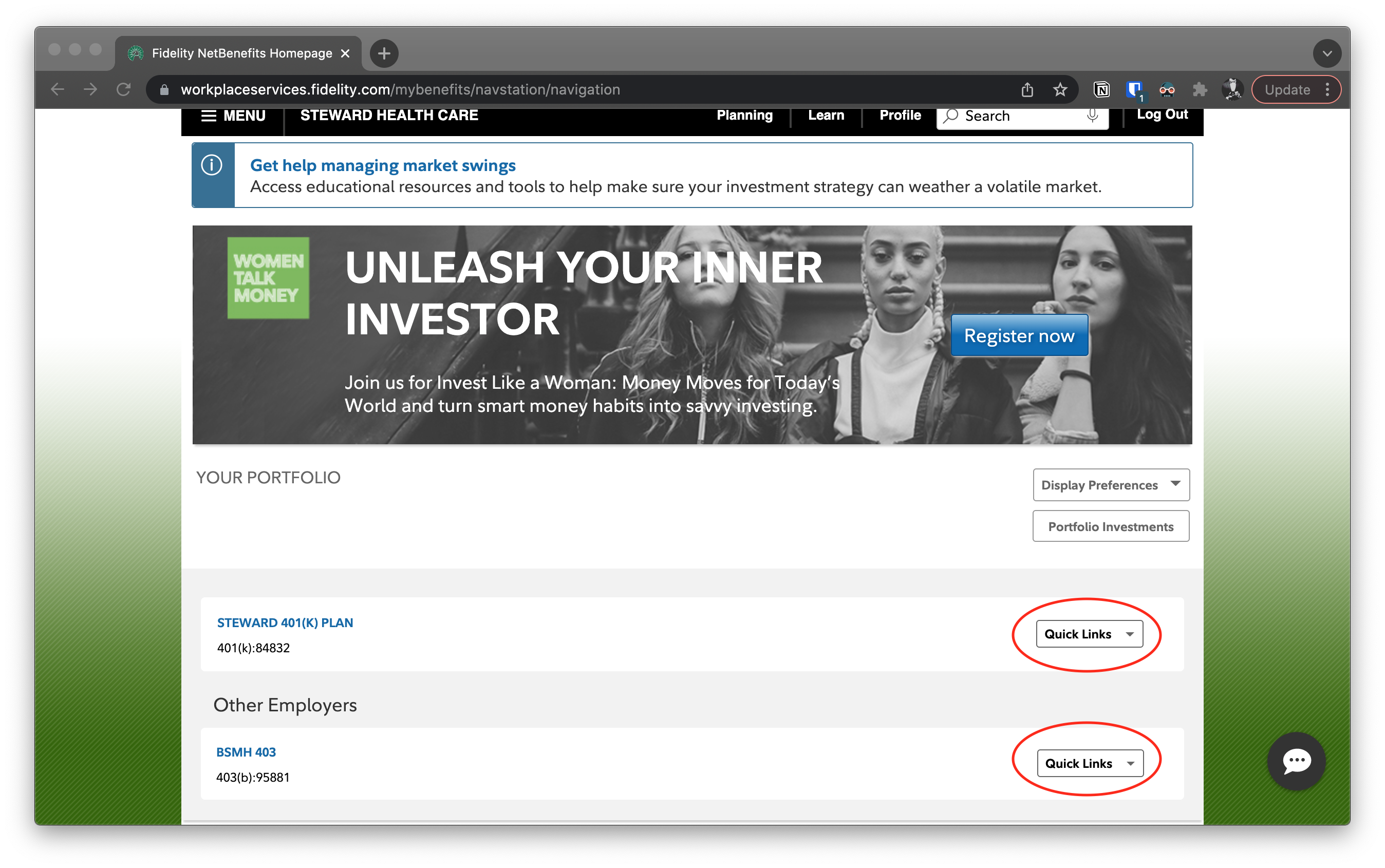

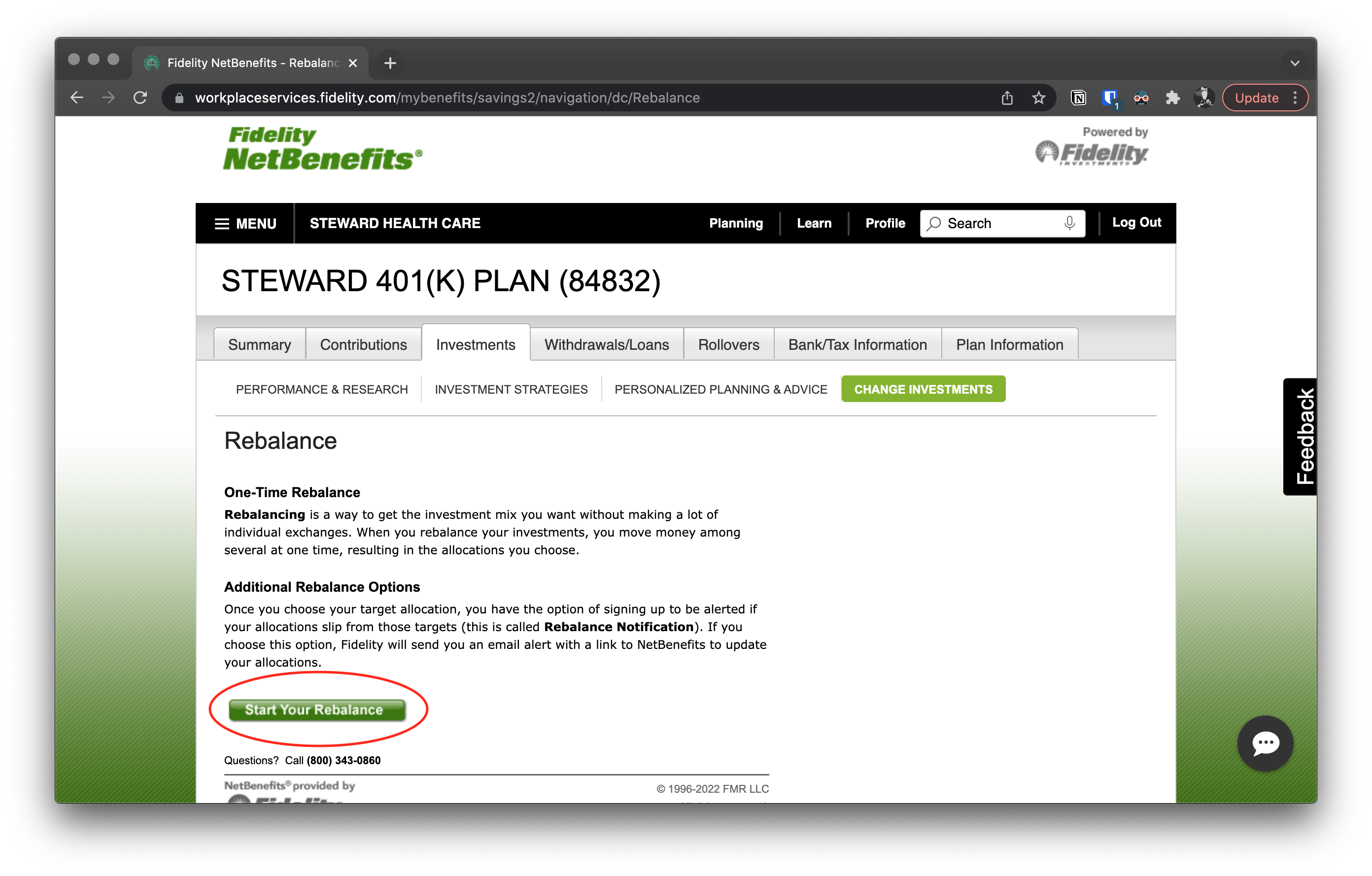

- Go to your 401(k) provider website and login. Unfortunately, I can only show you my process, so here it goes. Once you log in, find a way to make changes.

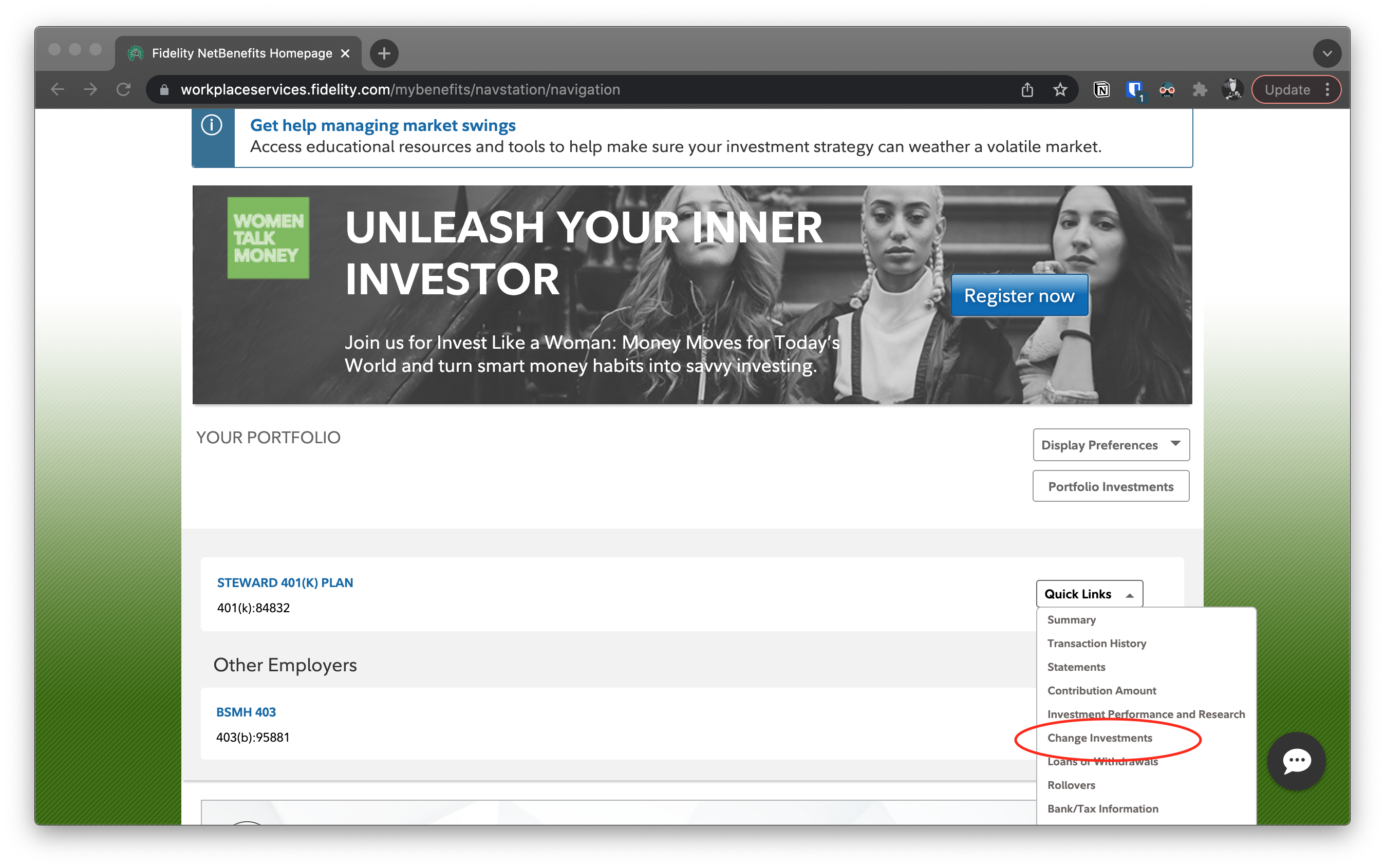

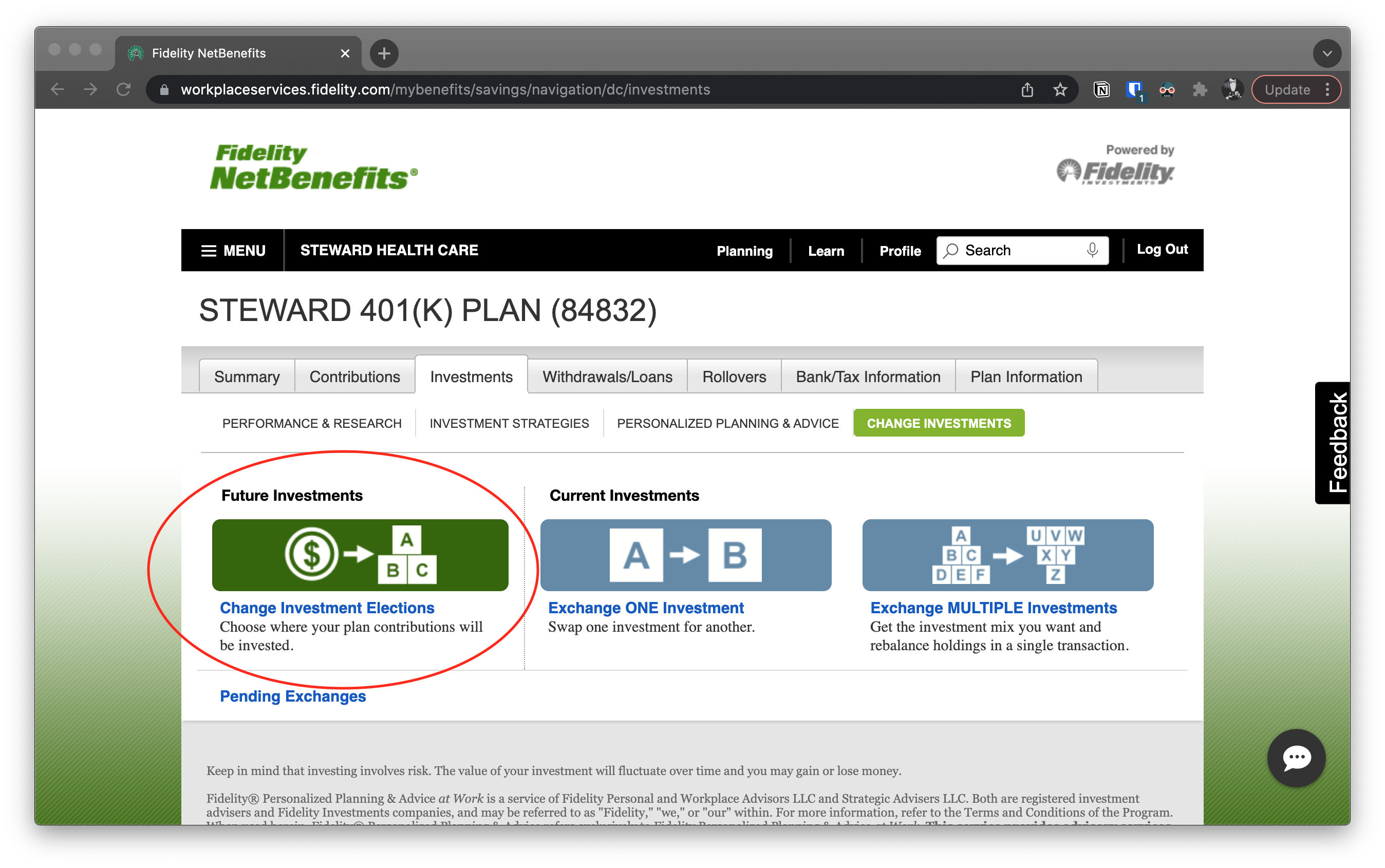

- Find "Change investments."

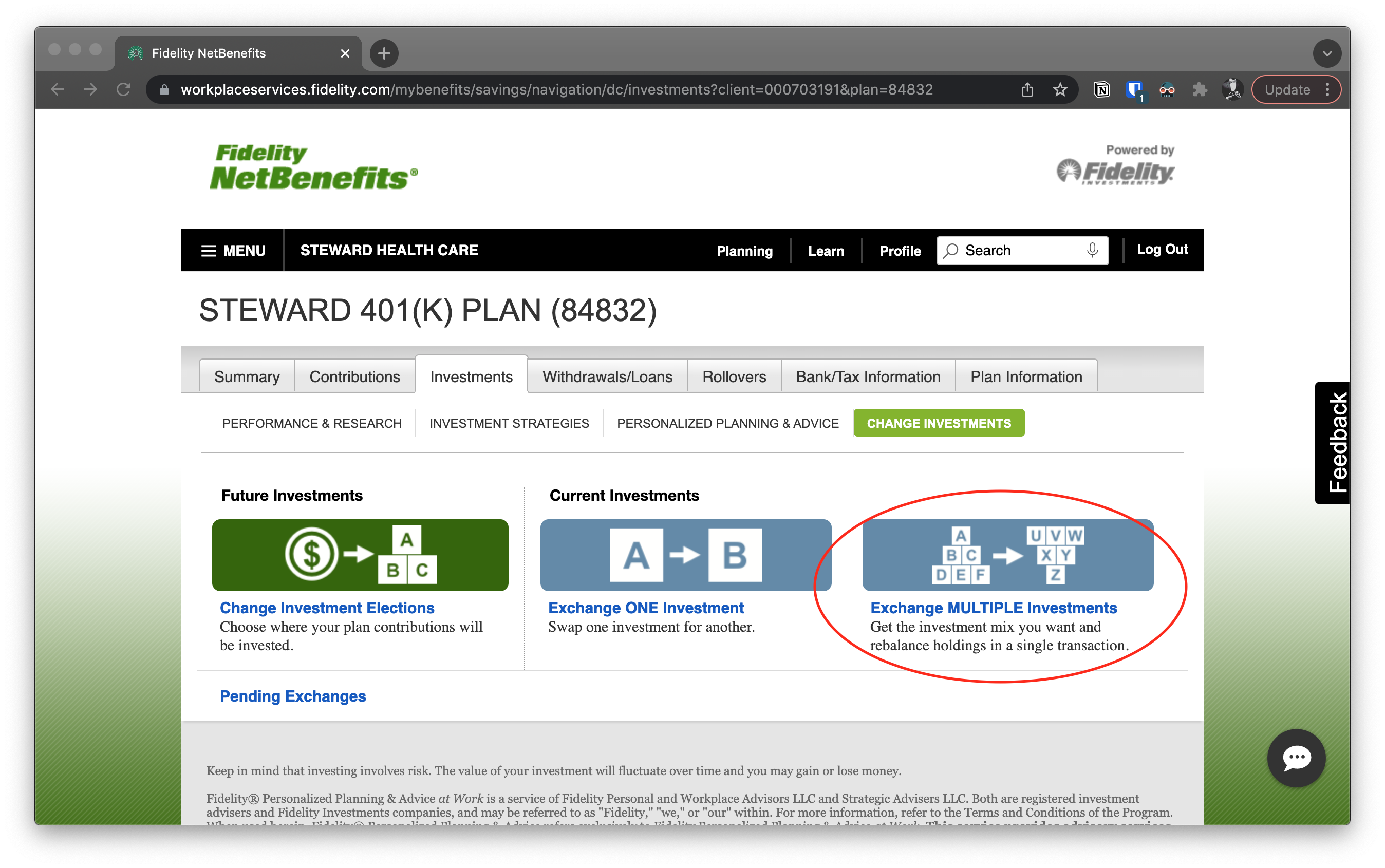

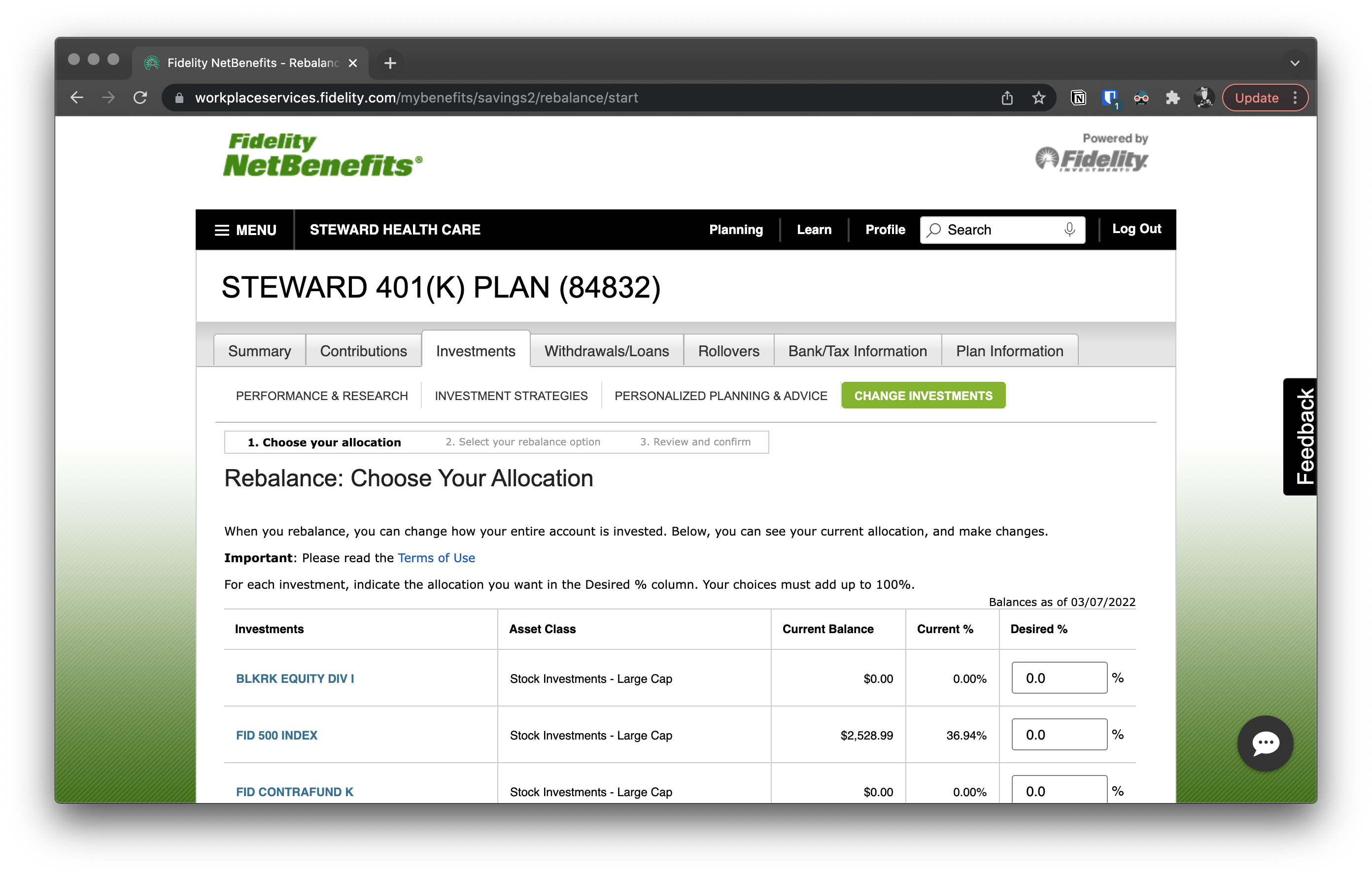

- First, we'll change the current investments. Later, we'll go into changing where your future money goes. Next click "Exchange Multiple Investments."

- Click on "Start Your Rebalance."

- Pick your funds.

Here, we get a long list of 15 different investment funds to sort through. This is where things can get overwhelming with too many funds and no way to tell them apart. You're not alone. Since the fund names are typed in blue, clicking on them will take you to page with more information on the fund in question. Alternatively, we can use a doctor's most hated know-it-all, Google. Type any of these fund names into Google and you'll find a breakdown of the fund.

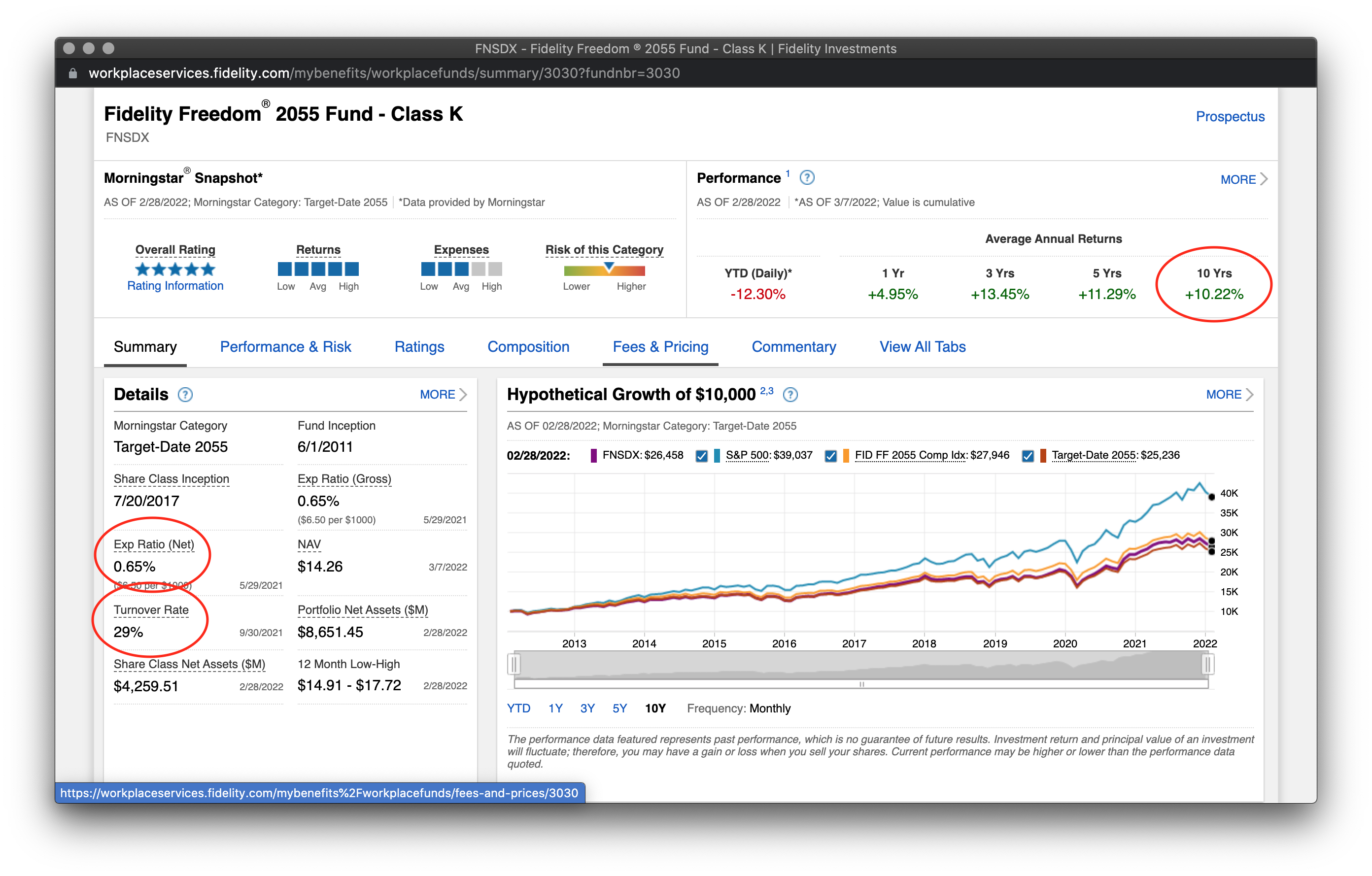

If you click on the blue fund name, you'll be directed to a page with lots of numbers and graphs.

Next, scroll down and click on Fidelity Freedom 2055 Fund - Class K (FNSDX).

I simplify shopping for funds by looking at three numbers:

- 10-year average annual returns

- Exp ratio (Net expense ratio)

- Turnover rate

This shows the breakdown for the Fidelity Index Fund (FXAIX).

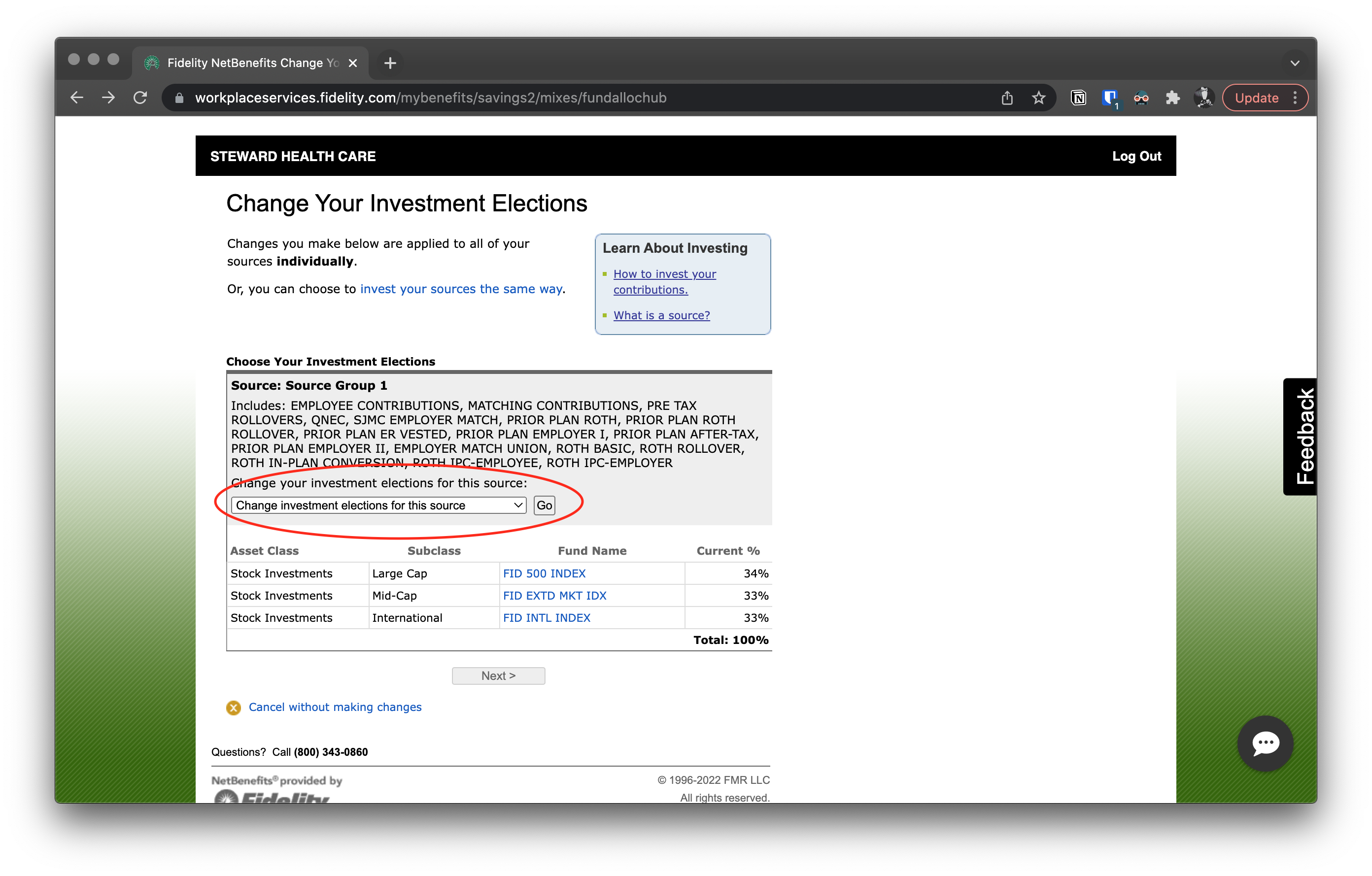

From your Asset Allocation screen, you can choose to put as much or as little of your money in whichever fund you want to put money into. You can split your money however you want: 50/50, 25/75, 33/33/33, or put everything into one fund. I'm not a financial advisor but I previously chose to split my money into three different index funds. The strength and weakness of index funds are that they match market performance. If there is a market crash around the time when I'm going to retire, the crash could take a big chunk out of my retirement fund. For me, since retirement is a long way off, getting market returns with a low expense ratio is the better option for me.

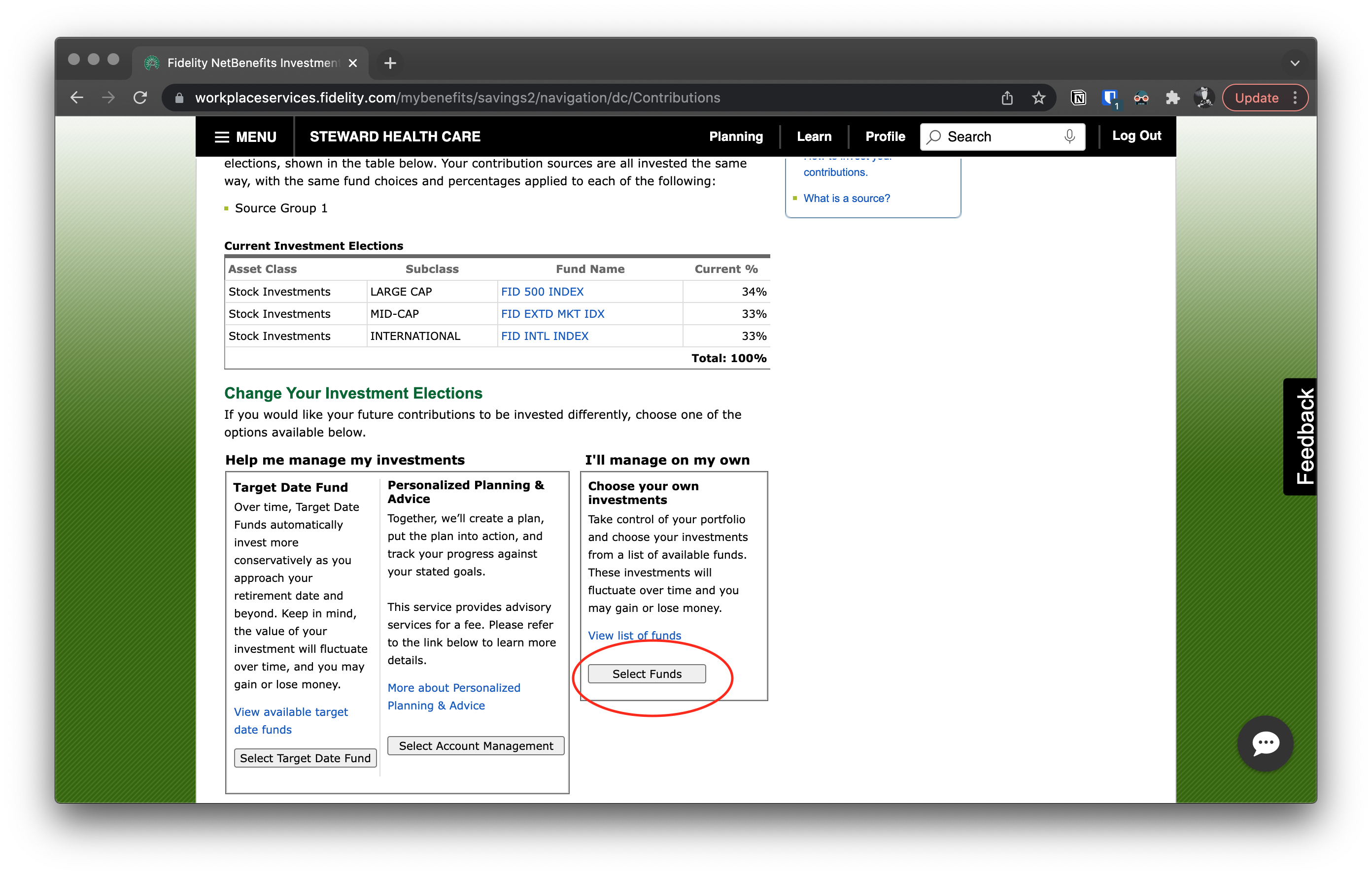

- Now, to make sure money goes toward future 401(k) contributions, we need to select "Future Investments."

- Find a way to choose your own investments, to prevent fund managers from picking funds that benefit them more than you. You're a pro now so you can hit "Select Funds."

- Click "Change investment elections for this source."

Here, we get a similar list of funds to choose from.

Make your selections like before and hit "Submit." The next few screens will offer to send more information to you.

Do your due diligence and read these files instead of just trusting internet strangers with your retirement money.